All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance coverage right approximately line of it coming to be a Modified Endowment Agreement (MEC). When you make use of a PUAR, you swiftly increase your cash money value (and your death benefit), thereby raising the power of your "bank". Even more, the even more cash money worth you have, the higher your interest and returns repayments from your insurance policy firm will certainly be.

With the increase of TikTok as an information-sharing system, monetary guidance and approaches have discovered an unique way of spreading. One such technique that has been making the rounds is the limitless financial idea, or IBC for short, amassing recommendations from stars like rap artist Waka Flocka Fire. While the technique is currently popular, its roots map back to the 1980s when financial expert Nelson Nash introduced it to the globe.

What is the minimum commitment for Policy Loan Strategy?

Within these plans, the money worth expands based upon a price set by the insurance firm (Infinite Banking concept). Once a considerable money value gathers, insurance policy holders can get a cash money worth loan. These car loans differ from conventional ones, with life insurance functioning as collateral, suggesting one can shed their protection if borrowing excessively without ample cash worth to sustain the insurance policy expenses

And while the allure of these policies is noticeable, there are natural constraints and dangers, requiring diligent cash worth tracking. The approach's authenticity isn't black and white. For high-net-worth people or business proprietors, particularly those utilizing approaches like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance growth could be appealing.

The attraction of unlimited banking does not negate its difficulties: Expense: The foundational requirement, a long-term life insurance coverage policy, is pricier than its term equivalents. Qualification: Not everyone gets approved for entire life insurance policy because of strenuous underwriting processes that can exclude those with particular health or way of life conditions. Complexity and danger: The detailed nature of IBC, combined with its threats, might hinder lots of, particularly when easier and less risky options are offered.

What are the risks of using Infinite Banking In Life Insurance?

Assigning around 10% of your month-to-month earnings to the plan is just not viable for most individuals. Part of what you check out below is simply a reiteration of what has currently been stated above.

So before you obtain right into a circumstance you're not gotten ready for, know the complying with first: Although the idea is commonly marketed therefore, you're not really taking a funding from on your own. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurance provider and need to repay it with passion.

Some social networks messages recommend utilizing money worth from entire life insurance coverage to pay for charge card financial obligation. The idea is that when you pay back the funding with interest, the quantity will be sent out back to your investments. That's not exactly how it functions. When you repay the loan, a portion of that passion goes to the insurance provider.

For the first a number of years, you'll be paying off the payment. This makes it incredibly difficult for your policy to collect value during this time. Unless you can afford to pay a couple of to numerous hundred dollars for the following decade or even more, IBC will not work for you.

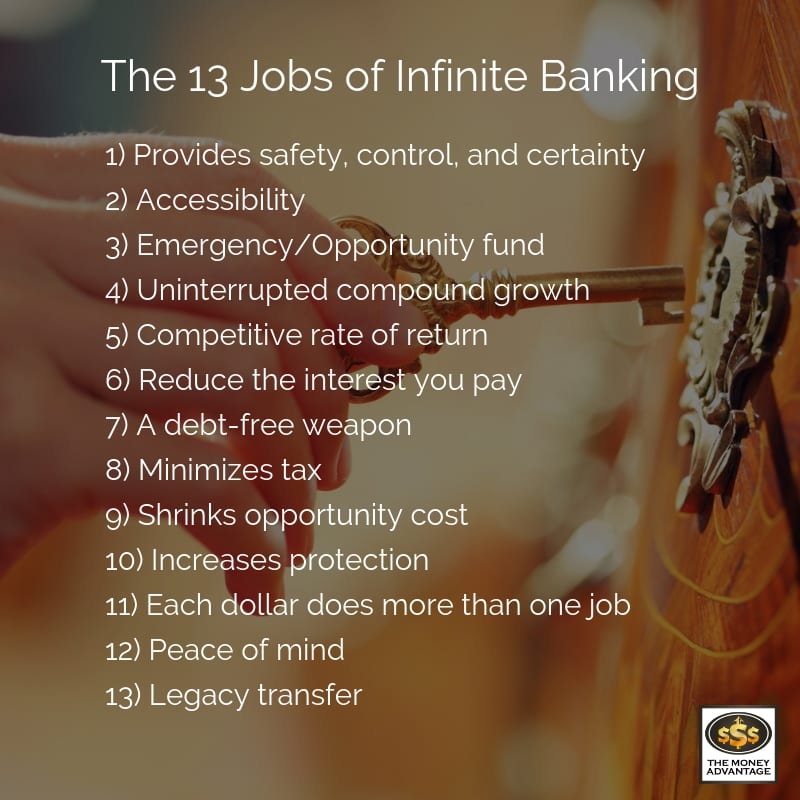

What makes Infinite Banking Benefits different from other wealth strategies?

Not every person ought to count solely on themselves for monetary protection. If you call for life insurance policy, here are some useful pointers to take into consideration: Take into consideration term life insurance coverage. These policies provide insurance coverage throughout years with considerable monetary commitments, like home loans, trainee finances, or when caring for young kids. Make sure to search for the very best rate.

Picture never ever having to stress concerning bank finances or high interest prices again. That's the power of boundless banking life insurance coverage.

There's no collection financing term, and you have the liberty to select the payment timetable, which can be as leisurely as repaying the loan at the time of fatality. Infinite Banking benefits. This versatility encompasses the servicing of the financings, where you can select interest-only settlements, keeping the funding equilibrium flat and convenient

Holding cash in an IUL taken care of account being attributed rate of interest can usually be better than holding the cash on deposit at a bank.: You have actually always desired for opening your own pastry shop. You can obtain from your IUL plan to cover the first expenditures of leasing an area, buying devices, and hiring staff.

Can I access my money easily with Self-banking System?

Individual car loans can be acquired from conventional financial institutions and credit unions. Borrowing money on a credit history card is usually extremely expensive with yearly percentage prices of rate of interest (APR) usually reaching 20% to 30% or more a year.

Table of Contents

Latest Posts

Your Own Bank

Bank On Yourself Review

Cash Flow Banking Strategy

More

Latest Posts

Your Own Bank

Bank On Yourself Review

Cash Flow Banking Strategy