All Categories

Featured

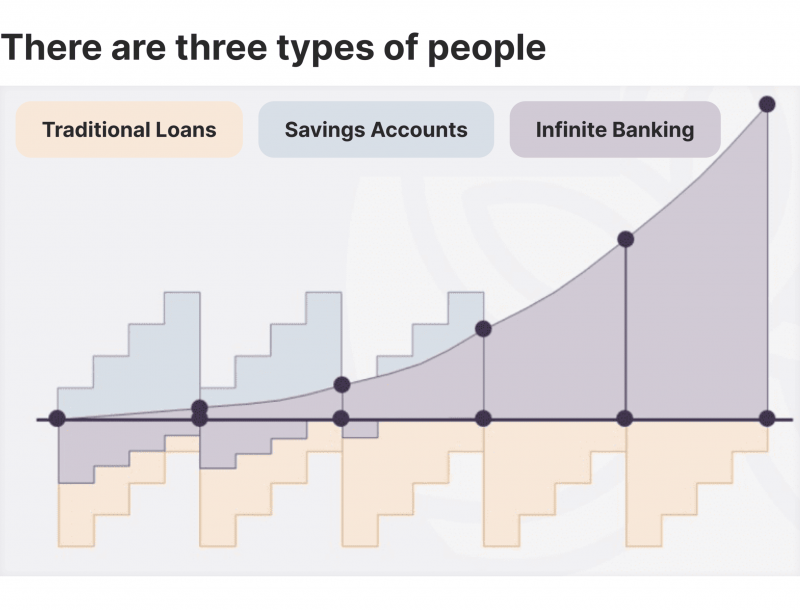

Whole life insurance policy plans are non-correlated assets - Leverage life insurance. This is why they function so well as the economic structure of Infinite Banking. No matter of what takes place on the market (stock, property, or otherwise), your insurance coverage maintains its worth. Way too many people are missing out on this crucial volatility buffer that helps secure and expand wide range, rather breaking their money into 2 containers: checking account and financial investments.

Market-based financial investments expand wide range much quicker yet are subjected to market variations, making them naturally dangerous. What if there were a third bucket that offered safety and security but also modest, surefire returns? Entire life insurance policy is that third pail. No matter just how varied you think your profile may be, at the end of the day, a market-based financial investment is a market-based investment.

Latest Posts

What are the common mistakes people make with Life Insurance Loans?

What are the most successful uses of Financial Independence Through Infinite Banking?

How do I leverage Infinite Banking Vs Traditional Banking to grow my wealth?

More

Latest Posts

What are the common mistakes people make with Life Insurance Loans?

What are the most successful uses of Financial Independence Through Infinite Banking?

How do I leverage Infinite Banking Vs Traditional Banking to grow my wealth?